ZATCA Phase 2 Integration of Accounting Systems in Saudi Arabia

The shift toward digital transformation through an E-invoicing system in Saudi Arabia has made it necessary to implement regulatory E-invoicing solutions. These solutions allow organizations to integrate with ZATCA Phase 2 easily. As a result, integrating accounting/ERP with ZATCA for Phase Two requirements of E-invoicing has become essential if not crucial for all taxpayers to ensure their compliance with all ZATCA updates.

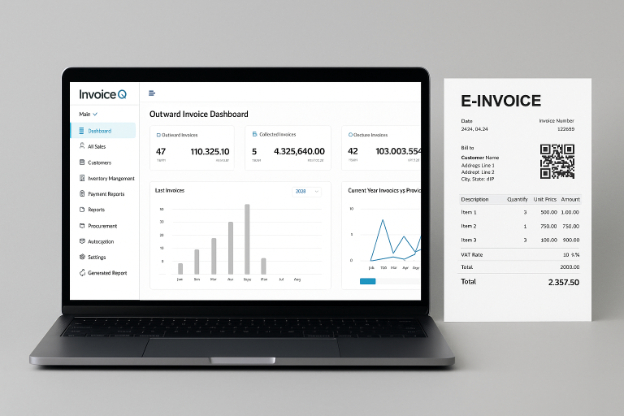

What is InvoiceQ?

InvoiceQ is a ZATCA qualified E-invoicing system developed to manage electronic invoices while adhering to ZATCA Phase 2 integration requirements in addition to Phase One as well. The E-invoicing system InvoiceQ offers is built to specifically meet ZATCA E-invoice and VAT (Value-Added Tax) requirements in Saudi Arabia.

On top of its friendly user interface, InvoiceQ is capable of integrating with both local and global accounting and financial systems. This enables businesses to maintain their existing systems while enjoying the added value of InvoiceQ’s E-invoicing and integration solutions.

Why is ZATCA Integration for Phase 2 Necessary?

As part of its efforts to improve transparency and tax compliance, ZATCA launched the E-invoicing initiative through the “ FATOORA ” platform. It consists of two main phases:

Phase One: Known as The Generation phase.

Phase Two: Known as The Integration Phase.

Key Differences Between Phase One and Phase Two of E-Invoicing

For business owners and accountants, understanding the differences between both phases is crucial to ensure compliance and avoid penalties. Below is a breakdown of each phase and how InvoiceQ simplifies the journey.

Phase One: The Generation Phase

Key requirements include

- Generating invoices electronically (not manually or via Excel/PDF).

- Including mandatory E-invoice elements such as:

- Tax Identification Number (TIN)

- Issue date

- Customer name

- VAT amount

- Including a QR Code for simplified invoices.

- No modification or deletion after issuance (adjustments only via credit/debit notes).

In addition to other details that have to do with the invoice type (B2B/B2C). The purpose of this ZATCA integration is to increase transparency, combat tax evasion, and streamline auditing procedures.

Phase Two: Integration Phase

Key requirements include

- Direct integration between the taxpayer system and ZATCA via.

- Sending invoices to the FATOORA platform for approval.

- Submitting invoices in XML format as per technical specifications.

- Taxpayers are notified in groups known as waves based on annual taxable revenue.

Preparing for Phase Two ZATCA integration may require working with a qualified E-invoicing system provider who possesses the technical capabilities and experience to manage full integration of your company’s system.

E-Invoice Management with InvoiceQ’s system for E-invoicing

When integrating with ZATCA, it’s not enough for a system to be compliant; it must also be dynamic, fast, and easy to implement. This is where InvoiceQ E-invoicing system excels through:

The System Provides The Following:

- Direct integration with ZATCA through various E-invoicing solutions.

- Automated generation of E-invoices with compliant QR Codes.

- Multi-language support.

- Secure data archiving with easy retrieval.

- Detailed reporting and precise analytics.

- Integration with local and international systems such as Microsoft Dynamics, Xero, Oracle, QuickBooks, SAP, and more.

- User roles and permission controls via custom workflow charts.

- Flexible invoice design based on the business personal branding.

Who Can Use InvoiceQ To Integrate with ZATCA?

InvoiceQ is designed for all types of organizations in Saudi Arabia, from SMEs to large enterprises. Thanks to its user-friendly interface and full ZATCA integration with Phase one and Phase Two, any organization seeking E-invoicing compliance can use InvoiceQ without technical complexity.

Avoid Penalties with Compliant E-Invoicing

One of the biggest risks businesses face is non-compliance with E-invoicing regulations. Any delays or errors in ZATCA Phase Two integration can lead to penalties. With InvoiceQ, ensure ongoing compliance of ZATCA updates, real-time invoice submission, notifications for rejected invoices (with rejection reason reason), and real-time tracking of invoice payment status.

InvoiceQ Key Clients

One of the biggest risks businesses face is non-compliance with E-invoicing regulations. Any delays or errors in ZATCA Phase Two integration can lead to penalties. With InvoiceQ, ensure ongoing compliance of ZATCA updates, real-time invoice submission, notifications for rejected invoices (with rejection reason reason), and real-time tracking of invoice payment status.