Co-authored by: Fadi Aljabali & Dana Asnan

Intro

The global economy has changed rapidly, often faster than countries, businesses, and regulations could ever keep up with. Along the way, new terms and frameworks started to appear. Some are well established, such as Letters of Credit (LC) and Letters of Guarantee (LG). Others, like Peppol and e-invoicing, are considered more recent yet increasingly essential and crucial.

Each one of them serves a different purpose, yet they all sit together within the same trade and financial ecosystem. To understand the real value of Peppol in the region, it’s important first to look at what LC and LG were designed to achieve, and where digital frameworks can now add efficiency, transparency, and scale.

Letter of Credit & Letter of Guarantee (LC & LG)

In essence, LCs and LGs were created to answer two simple questions: “If the goods are shipped, will they be paid?” And “If payment is made, will the goods be received?”

A Letter of Credit (LC) is essentially a bank’s commitment to pay the seller once specific, agreed-upon documents – typically shipping documents – are presented. Its primary focus is payment assurance.

A Letter of Guarantee (LG), on the other hand, is a bank’s commitment to compensate one party if the other fails to meet its contractual obligations. This could be a contractor failing to complete a project or a supplier not delivering as agreed. In short, LGs focus on performance rather than payment.

Both instruments are built on trust, risk mitigation, and documentation but they rely heavily on manual processes and paper-based verification.

E-invoicing

In simple terms, e-invoicing is the digital exchange of structured invoice data between sellers, buyers, and tax authorities. It ensures authenticity, accuracy, and traceability of invoice information. In other words, what started as a compliance requirement has now evolved into a value driver supporting operational efficiency, reducing disputes, improving cash flow, and strengthening trust between trading parties and regulators.

E-invoicing addresses the same fundamental need as LCs and LGs: That is, creating confidence that transactions are real, accurate, and verifiable

Peppol Network

Peppol is an open, international framework designed to standardize the secure and efficient exchange of invoices and procurement documents across borders. When a Peppol Certification Body (CB) certifies an organization, it confirms that the organization can operate using the same technical, security, and data standards used by governments, enterprises, and suppliers worldwide. In practical terms, this means the ability to:

- Communicate using a common language and agreed standards that are recognized across regions and jurisdictions.

- As a Peppol Access Point (AP), enable local businesses to send and receive electronic invoices seamlessly through the global Peppol network.

- As a Service Metadata Publisher (SMP), ensure businesses are discoverable on the network so documents are routed correctly and reach the intended recipient.

What Does Peppol Network Mean To Local Companies?

For local businesses, Peppol certification is an enabler, an opportunity for:

1. Global Reach:

40+ countries is the total number of countries using Peppol across the world, and this number will only continue to grow rapidly as the e-invoicing wave advances. Local companies participating in this network get a direct line of communication to global markets.

2. Compliance & Trust:

Governments in Europe and Asia already mandate Peppol in their procurement frameworks. The Middle East is the next natural phase, and early adoption will position companies ahead of the curve. The UAE and Oman have already announced the adoption of the Peppol 5-Corner Model.

3. Efficiency & Cost-Saving:

Peppol-based document exchange can reduce manual errors and related costs by up to 60% compared to traditional custom integrations between different systems.

4. Financial Inclusion:

Seamless E-invoicing in banking formats is often SMEs’ first door to ensure better access to funding and credit.

In other words: Peppol is not just about compliance, it’s a growth and access tool that local companies can use to scale in global markets with greater confidence.

Value for Trade Finance (LCs and LGs)

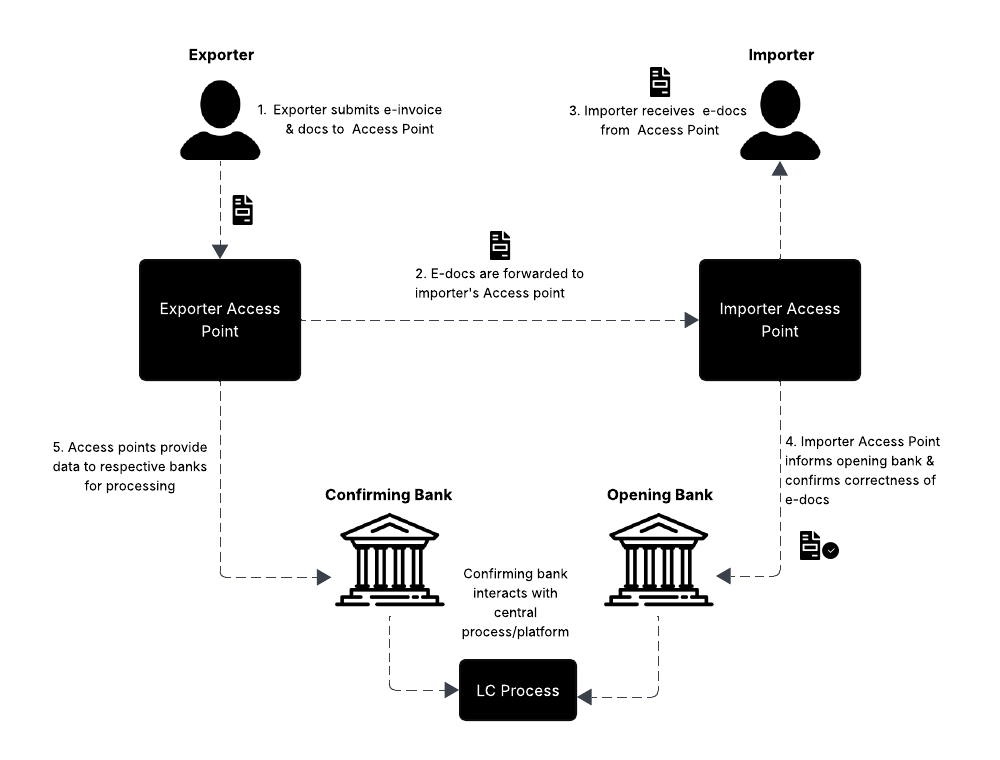

For companies doing business with international trade finance in the form of Letters of Credit (LCs) or Letters of Guarantee (LGs), Peppol certification adds additional value and differentiators.

1. Faster Settlements:

Banks can receive standardized, validated e-invoices and procurement documents instantly, cutting time to process LCs.

2. Reduced Risk:

Digitally signed, interoperable invoices minimize risk of fraud and mismatch, increasing acceptance rates by banks and making LC execution more reliable.

3. Better Guarantee Issuance:

LGs for importers and exporters backed by Peppol-certified, validated, and verified invoices give banks more confidence in contract performance and reduce duplication.

4. Auditability & Transparency:

Each invoice is 100% traceable and stored digitally, supporting international banking standards and audit compliance.

5. Lower Financing Costs:

If the risk of fraud or mistake decreases, and the overall documentation integrity improves, we may also notice benefits in financing costs.

For importers, exporters, and banks working on the issuing side, LCs and LGs become more secure, more efficient, and more trusted.

Who Can Enable Peppol At Scale in The Region

Peppol adoption at scale does not happen through individual companies handling the connection to the network on their own. It requires trusted regional enablers – known as accredited service providers – that can operate within global Peppol governance while also understanding local regulatory, tax, and business realities.

Today, InvoiceQ, as a certified Peppol Access Point (AP) and Service Metadata Publisher (SMP), plays this role by enabling secure document exchange and trusted participant discovery ensuring documents are delivered to the right destination, in the correct format, every time.

Put Simply, From A Business Value Perspective.

Any company – regardless of its location – whether it’s in Amman, Riyadh, Dubai, or elsewhere; can exchange invoices and procurement documents electronically with its parent company, suppliers, or customers through the network, even when those parties are based in Singapore, Brussels, or any other global market.

Because all participants operate under the same internationally governed framework; document exchange is secure, verifiable, and trusted. The transmission of data takes place globally without geo-restrictions, delivering the same level of confidence and reliability as if all parties were operating within a single country.

What’s Next for Peppol Network?

Peppol should be viewed as a foundation rather than an end goal. It represents the starting point of a broader shift in how businesses exchange data, comply with regulations, and participate in global trade. Building on this foundation.

The next phase of e-invoicing can be envisioned around three practical directions:

1. Expanding Peppol-Enabled Services Expanding beyond early markets such as Jordan and KSA, into the wider GCC and MENA region would allow local businesses to connect seamlessly with regional and global trading partners through a unified interoperability framework.

2. Building Value-Added Services on top of Peppol Infrastructure This includes real-time compliance validation, cross-border invoice financing, and deeper alignment with trade finance instruments like Letters of Credit (LCs) and Letters of Guarantee (LGs), moving e-invoicing beyond compliance into a business enabler.

3. Enabling Simple Peppol Onboarding For businesses of all sizes From SMEs to large enterprises, as this can help ensure inclusive adoption, reducing technical and operational complexity for both SMEs and large enterprises.

In This Context,

InvoiceQ’s role as a Peppol Access Point (AP) and Service Metadata Publisher (SMP) can be seen as more than a regional platform. It acts as an early bridge connecting companies and banks in the Middle East with global standards already used by their international parents and partners.

The fact that this capability is built and operated by MENA and GCC experts reflects that the region is not simply following the global digital trade transformation but is increasingly positioned to lead it.

Takeaway,

Peppol certification is not only about interoperability but also about unlocking a new opportunity. From empowering SMEs to competing globally, to streamlining trade finance for enterprises, it represents a critical step toward a more trusted, connected, and efficient regional trade ecosystem. Ready to Unlock the Power of Peppol?

Ready to Unlock the Power of Peppol?

Discover how InvoiceQ can help your business achieve compliant, scalable e-invoicing and connect seamlessly to global trade networks. Book a free demo with our team of experts.