Intro

Exchanging data effectively has become crucial now more than ever. This can be attributed to the fact that business documents including invoices are being shared now electronically or over a global network such as Peppol.

Taking that into consideration, data transfer in real-time is now a key element of any modern business and learning the best Continuous Transaction Controls (CTC) models by which this data can be sent and received is crucially important to ensure a successful exchange flow between all parties involved.

Luckily, at InvoiceQ our expertise has enabled us to understand these various models we’re about to share with! That said, do you know the main CTC document exchange models? Stick around as we understand the key exchange data models and how they work.

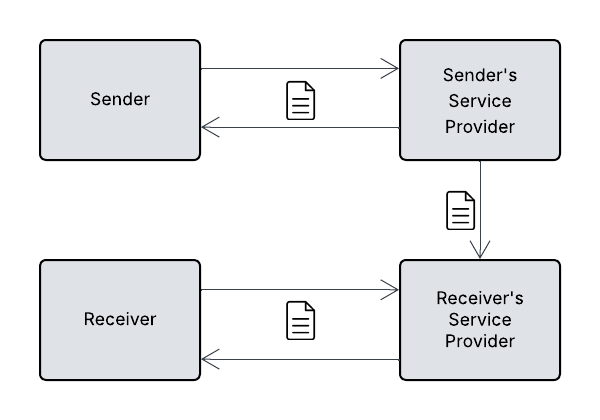

1. Interoperability Model

The interoperability model or the 4-corner model is a data exchange model that focuses on creating a system where different participants can share their data documents directly and easily from one party to another through software systems. The data exchange in this model happens in near real-time and can be adapted to each country’s specification.

The exchange happens within a network that relies on private service providers who will be in charge of regulating the sender and the receiver’s data without a direct communication between the sender and the receiver themselves. Each system is equipped with Application Programming Interfaces (according to the implementation’s specification, eg: API) that talk to other systems within the network.

The governing authority establishes the obligatory technical rules that must be followed for any electronic business document that has to be shared, whether it’s an e-invoice or any other type of business documents.

The Peppol 4-corner model (which is a specific implementation of the 4-corner model) can be considered as an implementation of this model. Countries that use this model include Australia, Russia, Singapore, and Switzerland.

How Does it Work?

The sender’s system sends the document via its service provider in charge, and the service provider in turn shares it with the receiver’s service provider who will also be in charge of sending the received document to the receiver’s system after validating the document.

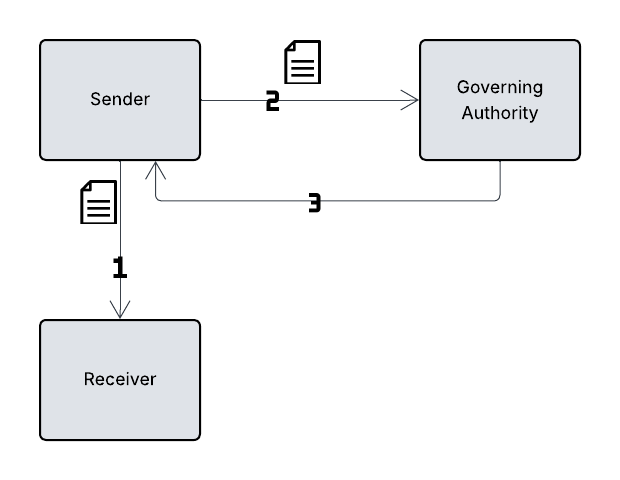

2. Real-Time Reporting Model

In the real-time reporting model, the document is sent from the sender’s system to the receiver immediately (in real-time). According to the country’s governing legislation, the document is shared with the authority simultaneously or shortly after in a duration that is specified by the country.

For example, The B2C invoice model in Saudi Arabia implements a real-time reporting model. The supplier has to send the invoice to the customer immediately and report it to ZATCA (tax authority in KSA) within 24 hours. The key point in this model is the immediacy of the data transfer from the sender (supplier) to the receiver (buyer). Other countries that implement this model include Hungary and South Korea.

How Does it Work?

The sender (supplier) sends the document/invoice to the receiver (buyer) immediately and at the same time or shortly after – (according to the timeframe the governing authority has set eg: 24-72 hours) – to the governing authority so it’s validated. After validating the document/invoice, the document is sent to the sender (supplier) by the governing authority.

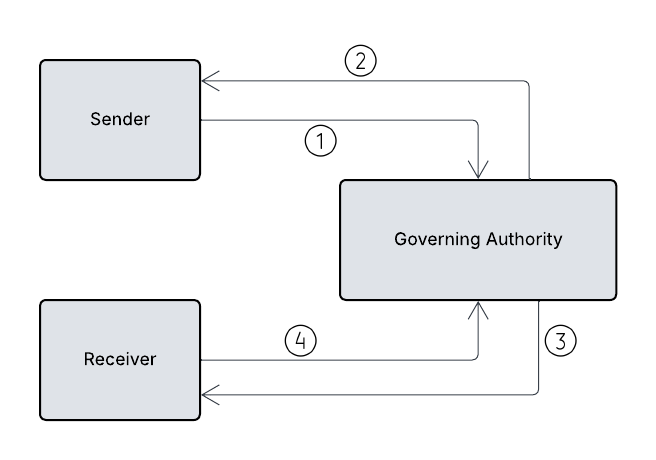

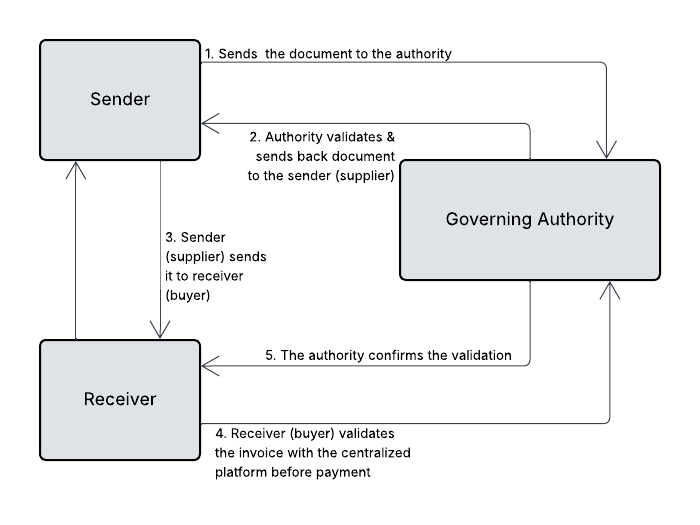

3. Centralized Model

The centralized model doesn’t allow direct communication between the sender and the receiver (supplier & buyer). Instead, the communication happens via a centralized single source of truth (SOT) such as the tax authority’s regulating system.

Data from all sources is sent to this single source of truth system that acts as the central repository of all data sent and received. This model brings order and control to the data exchange process. Any document shared between the parties involved has to be validated first by the central platform. Countries implementing this model include Italy, Kazakhstan, Egypt and Turkey.

How Does it Work?

The sender shares the document/invoice with the source of the truth system. For example, the centralized e-invoicing system of the government. After that, the government validates the document or invoice and sends it back to the sender (seller) and to the buyer.

Similarly, the receiver receives the document from the centralized governing system (SOT) and shares it back with the governing system if they need to send a document. Bottom line is, no direct communication happens between the sender and the receiver. Sharing and receiving the documents only happens via the centralized point.

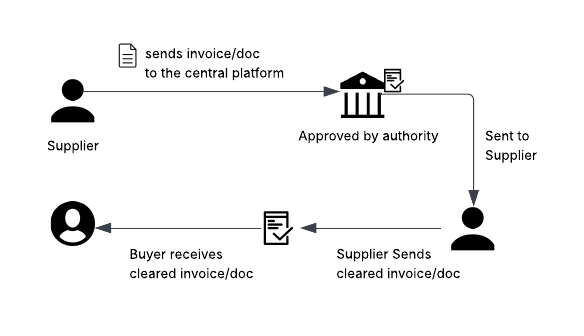

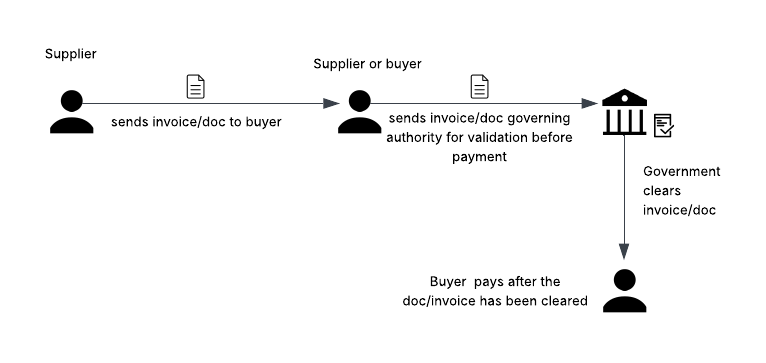

4. Clearance Model

The clearance model follows a delayed or scheduled approach for document data transfer, the data can be exchanged as a single batch and accumulated over a period of time to be sent after either in real-time or near-real-time to the governing authority as a single batch.

It’s a clearance model as the data exchanged from one party to another has to be cleared and validated by the governing authority first before it’s received by the second party. This model may provide invoice/document clearance before sending it to the receiver (buyer) or after sending it to the receiver (buyer).

How Does it Work?

A) Pre-clearance (Before sending it to the buyer)

- The supplier sends the invoice/document to the governing clearance platform and gets the approval after the governing platform validates the document/invoices and clears it.

- The supplier then sends the cleared invoice/document to the receiver (buyer).

- Example countries: Brazil, Colombia.

B) Post-clearance (After sending it to the buyer):

- The supplier in this model sends the invoice to the buyer first

- The supplier or the buyer submits the same invoice/document to the governing authority shortly after – before paying – to the invoice/validate and pay for it the invoice after authority clearance.

- Example countries: Chile.

Choosing The Right Model

The best data exchange model depends on your specific needs. Do you need immediate access? Consider Real-Time Reporting. Do you need a single source of truth? The Centralized Model is a strong choice.

If your systems need to communicate directly without a central hub, the Interoperability Model might be right for you. And if validation and integrity are paramount, the Clearance Model is your go-to.

With InvoiceQ, you don’t have to choose blindly our expertise in working with the different CTC exchange models enable us to help businesses, each according to its governing local legislation. We make compliance accessible across different jurisdictions (e.g., ISTD, ZATCA, ETA, FTA, Peppol).

Need help ensuring your invoice exchange compliance? Get in touch with our team of experts for a free consultation!